BY ANTHONY KING | 17 JANUARY 2024

Used EV batteries are hard to come by, but the numbers are expected to soar in the next two decades. Recycling their valuable metals is a priority, Anthony King reports

When battery chemist Andrew Abbott sought used batteries from electric vehicles to study them for recycling, he hit a brick wall. Initial searches turned up empty handed. ‘There is surprisingly little dead battery material on the market,’ says Abbott, a professor at the University of Leicester, UK. Batteries in EVs are lasting longer and cars are going through more owners than initially thought. Eventually, Abbott’s group bought an old Nissan Leaf to get their hands on its battery.

However, dead lithium-ion car batteries won’t be a rarity for long. Around 21% of all new car registrations in the EU in 2022 were electric, with Norway and Sweden zooming ahead in Europe. In the UK, more than 265,000 battery-electric cars were registered in 2022, a rise of 40% on 2021. Business magazine Forbes reported that demand for EVs will plateau in 2024 but reach almost 50% of global sales by 2030. For the UK alone, volumes of EV batteries for recycling are expected to reach 28,000t by 2030, rising to 235,000t in 2040. Around 1400 vehicles a day, half a million/year, are expected to become available for recycling by 2040, says Abbott.

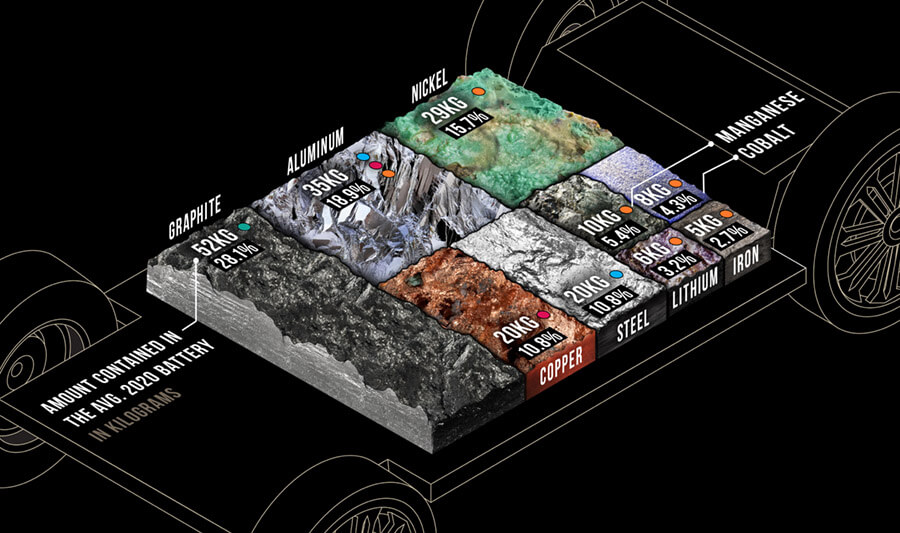

Infographic showing the minerals found in an electric vehicle (EV) battery. The average EV lithium-ion battery with a 65 kilowatt per hour capacity contains around 185 kilograms of minerals. Data from the European Federation for Transport and Environment based on the average EV battery in 2020. Image: Visual Capitalist / Science Photo Library

EV batteries can contain over 200kg of metals, with up to 30kg of nickel and 8kg of cobalt. That translates into enormous business opportunities for recyclers. Also, Western governments are increasingly worried about sourcing critical metals from unreliable partners: the largest cobalt reserves are in the Democratic Republic of Congo; Russia is a major producer of nickel; while most lithium is mined in South America and Australia and processed in China. In 2023, the EU adopted new regulations to set a target for lithium recovery from battery waste. Minimum levels of recycled content for EV batteries were set at 16% for cobalt, 6% for lithium and 6% for nickel. EV batteries will also be required to display their carbon footprint. The UK is expected to follow the EU’s lead.

In the US, the 2022 Inflation Reduction Act prioritised domestic sourcing. By 2027, 80% of critical minerals in EV batteries must be mined or processed in North America or countries with a free trade agreement with the US. Or they must be recycled in North America. By 2029, all components must be manufactured or assembled in the US.

Olde recycling

In Europe, the largest battery recycler today is Umicore, with a plant in Hoboken, Belgium, capable of recycling 7,000t of Li-ion batteries and battery production scrap/year – equal to 35,000 electric vehicles. The company starts with battery dismantling and then high temperature smelting to convert batteries or battery scraps into metal alloy containing cobalt and nickel. ‘Everything is thrown into a big furnace and gets melted. Then you get a big block out of it with metals,’ says Maximilian Fichtner, a battery chemist at Karlsruhe Institute of Technology in Germany. ‘It’s not so energy intensive, because batteries contain combustive parts like the electrolyte.’

Next, metals are separated using a hydro-metallurgical process. This usually relies on leaching the various ions using sulphuric or hydrochloric acids and powerful redox agents such as hydrogen peroxide. This can generate battery salts of interest such as nickel sulphate and cobalt sulphate. UmiCore says its latest technology recovers over 95% of cobalt, copper and nickel from various battery chemistries. A 150,000t plant is slated for 2026.

Another approach is to dismantle, crush and shred batteries to generate ‘black mass,’ rich in lithium, manganese, cobalt and nickel. Size, density and magnetic separation can be used to extract different materials. The biggest manufacturer of cathode materials in Europe, BASF is building a production plant for black mass in Schwarzheide, Germany. It is already making NMC (nickel-manganese-cobalt) precursor battery materials at this site – NMC is what the cathode is made from. Fortum in Finland takes black mass from its facility in Germany and boasts recovery of over 95% of the metals, including cobalt, nickel and manganese.

In Sweden, Northvolt has built a large-scale recycling facility beside its first gigafactory near the city of Skellefteå with a capacity for 20,000t/year of battery materials. Its black mass is mixed with an acid solution to dissolve the metals; impurities such as copper, iron and aluminium are removed; and the mix of nickel, cobalt and manganese is crystallised out as NMC sulphates.

Glencore is the largest Western recycler, processing black mass from several American and European pre-processes. It often works with Li-Cycle in Canada. Other companies at various stages are Redwood Materials, Ascend Elements and Cirba Solutions in the US, and Veolia, Eramet and Nickelhütte in Europe.

Recyclers rely for now on production scrap or batteries that failed quality checks, possibly up to 10% of production. ‘At the moment, we have 38 recyclers in Europe, and they all suffer because they do not get enough batteries,’ says Fichtner. China leads in terms of quantity and advanced processes and is building recycling plants adjacent to major manufacturing facilities, giving it a distinct edge. China already boasts two plants with a capacity to recycle 200,000t/year of battery, says Abbott. Europe has a lot of catching up to do.

Still, there is a consensus that recycling processes are ripe for improvements. Most processes ‘are old-fashioned bulk chemistry, slow and laborious,’ says Abbott. This view is widely held. ‘All over the world, it still looks a bit like 18th century chemistry with a lot of acid leaching during the hydrometallurgical steps,’ says battery chemist Magda Titirici at Imperial College London, UK. Recycling processes today usually fail to recover lighter metals, such as aluminium and lithium, which get siphoned off to the slag.

Within a decade, when colossal quantities of Li-ion batteries become available, lithium will need to be recycled. ‘Lithium is very valuable and is often the most valuable component in the battery,’ says Hans Eric Melin, founder of the consultancy Circular Energy Storage. Lithium carbonate prices averaged $8400/t in 2020 – rising to $81,000/t in December 2022. The overall value inside batteries shot up as a result. ‘We got crazy prices for waste batteries because they were implicitly priced on lithium and recyclers not recovering lithium had difficulty acquiring batteries,’ says Melin, adding that most recyclers in South Korea and China are already recycling lithium.

Future recycling

Plant for processing lithium chloride into lithium carbonate for use in the production of batteries. The lithium chloride is extracted from mineral-rich brine in large evaporation ponds. Photographed in the Atacama Desert, Chile.Image: Philippe Psaila/ Science Photo Library

Lithium prices dropped towards $20,000/t in 2023. Nonetheless, there are strong economic and regulatory incentives for new processes to recover more manganese, copper, aluminium, lithium and graphite. For example, the EU has mandated a recycle rate for lithium of 35% in 2026, rising to 75% in 2030. For now, Melin believes this will advantage China, since that is where most production and recycling takes place.

Meanwhile, firms are announcing improvements in hydrometallurgical processes. BASF says it will lean on a proprietary solvent extraction and electrolysis process to recover lithium from its black mass. Solvay in France similarly has a process to improve lithium extraction. A big hope is direct recycling, as pursued by researchers and several startup companies. In theory, this could send valuable compounds back to a battery manufacturer for re-use in future EV batteries without complicated extraction. ‘It means splitting off the anode and cathode chemistries, delaminating and getting your active materials back again,’ says Abbott. ‘The advantage is that you retain the value.’

Abbott is part of Recycling of Lithium-Ion Batteries (ReLiB), a Faraday Institution project that aims to boost the sustainability of Li-ion batteries when they reach the end of their life in EVs. As part of a push towards direct recycling, Abbott and his colleagues have looked into opening battery cells up to extract the anode and the cathode material directly for re-use. This can be more challenging in some cases than others. EV batteries traditionally contain a lot of packaging. First there are cells, larger than chocolate bars, which are packed into modules the size of shoeboxes. Perhaps 16 modules are then placed in a container and the battery is wired.

‘The biggest fraction of weight, roughly 75%, is taken up by containers, additives, cables and stuff,’ says Fichtner. Just 13% is active cathode material that can hold charge, he estimates. Improving the cathode chemistry therefore only impacts 13% of battery weight. A Tesla Model S, for example, contains around 4000 small cylindrical battery cells that are glued together, complicating access to the chemicals responsible for delivering power.

One advance Abbott led is to use ultrasonic waves to blast NMC and graphite off the current collectors, leaving behind untainted aluminium or copper. This facilitates disassembly. The process was shown to work in removing graphite and NMC oxides (Green Chemistry, doi: 10.1039/D1GC01623G). Direct recycling has plenty of support.

‘It’s a great opportunity to get materials back from recycling and its quite different from the usual hydro and pyro processes,’ says Jeff Spangenberger, head of materials recycling at Argonne National Laboratory in Illinois, US. ‘It’s a game changer because half the cost or even more can come from making the cathode.’ If you extract the cathode, tweak it to improve it and place it back inside a new battery, this will save the cost of having to manufacture the cathode, he adds.

There are a number of catches, however. First it is necessary to segregate different Li-ion battery recipes, so multiple lines would be needed in a recycling facility. Including old recipes that are no longer popular. At Argonne, Spangenberger focuses on upcycling old cathodes to make them perform like a more modern cathode. One way is to add nickel. But none of this is easy. ‘There’s lots of challenges,’ he says. ‘And that’s why industry hasn’t been terribly active with research into direct recycling.’

Iron-age returns

Anyone attending a battery conference five years ago was likely to hear a lot about NMC cathode chemistries for future EVs. In 2022, this remained the dominant battery chemistry, with a market share of 60%, according to the IEA. But in 2020, Chinese battery giant BYD unveiled ‘the blade battery’ - a lithium iron phosphate (LFP) battery for EVs.

LFP has lower energy density and shorter range than NMC batteries. Carmakers in the West were bent on stepping up energy density and lowering the cobalt content to reduce cost and ease range anxiety amongst consumers. BYD upset the apple cart by engineering single-cell batteries that were almost 1m long and 10cm wide, placed into a battery pack like a blade. This design reduced the amount of packaging material by about 40%, boosting active cathode volume by almost 50%, according to some estimates. This allowed use of cheaper LFP, compensating for its lower energy density.

LFP batteries are gaining traction. In 2021, Tesla turned heads by announcing a switch to LFP packs in standard range models. In 2023, Ford said it would switch to LFP cells, licensed from China’s battery giant CATL, for its electric Mustang Mach-E. By 2022, LPF had a market share of just under 30%. They also don’t require problematic cobalt and are more durable to heat and high voltage, with slower degradation. ‘A lot of the lithium-ion industry is moving back to LFP, which is a more sustainable cathode,’ says Titirici. The iron and phosphate rock can be mined, or the phosphate could potentially be recovered from wastewater.

LFP has history in buses, forklifts and energy storage. ‘Many recyclers today charge something like $4-5/kg to take LFP batteries. That’s a huge market opportunity,’ says Melin, for anyone who can boost recycling efficiency and take a slice of a burgeoning recycling market. There is another advantage too. ‘Direct recycling for LFP would be interesting because it’s a fairly stable battery chemistry,’ says Melin.

Designing batteries to be more recyclable has previously been an afterthought. But the blade batteries step up here too. ‘The anode and the cathode chemistries are at the opposite end of the cell, so you can just pull them apart and you’ve something a lot easier to recycle,’ says Abbott. His group is also trying to replace various binders and polymers with materials that are easier to remove, as well as looking at robotic disassembly of battery packs. Chemists are also tweaking LFP, especially by adding manganese (LMFP). This doesn’t make it cheaper but makes it more powerful. Still, there could be more sustainable battery chemistries out there vying for the EV market. ‘LFP still has lithium, a critical material. If we could achieve the same with sodium-ion, potentially we could be more sustainable,’ says Tirici.