Industrial biotechnology is extending its reach to new areas. As well as lowering carbon emissions by reducing reliance on petroleum, it also creates chemicals from sustainable sources. Lou Reade reports

Although industrial biotech is not new – with products like engineered enzymes for detergents already well-established – a recent report from global research consultancy IDTechEx analyses the future potential of industrial or white biotechnology and notes that it is extending its reach into new applications, driven by its potential for carbon reduction.

Sona Dadhania, Senior Technology Analyst at consultancy IDTechEx, forecasts that industrial biotech capacity will triple over the next 10 years. The company estimates current capacity at around 1.6m t/year for chemical intermediates and polymers but excluding products such as fuels and enzymes. Meanwhile, a 2023 report from the Institute for Manufacturing notes that ‘modern industrial biotech’ firms have a turnover of £4.7bn in the UK.

To go back to basics, biotechnology uses living organisms – such as bacteria, yeast and fungi – to produce chemicals, materials and even energy. The original organism is often modified to make a specific end-product or increase its yield. Dadhania cites Illinois, US-headquartered biotech LanzaTech, which has engineered bacteria to metabolise greenhouse gases (GHGs) and convert them into ethanol and other important chemicals more efficiently.

‘Many organisms naturally produce things that we need – so why not engineer them to be even more effective?’ says Dadhania. ‘Part of the tweaking process is to increase the yield of the molecule that we want and suppress any unwanted byproducts.’

A critical challenge is to scale up these lab-based processes. Many processes that work in the lab cannot be transferred to industrial scale. Moving from batch to continuous production may not be possible and the need for multiple downstream processes adds time, complexity and cost. Petroleum-based molecules also have strong supply chains and economies of scale – which further stacks the odds against a bio-based route.

‘The biotechnology space is littered with failures and bankruptcies,’ says Dadhania. ‘One reason is that moving from the lab to the industrial scale is so difficult.’

Most of the more amenable compounds for biotech manufacture are typically those that compete strongly with petrochemicals-based routes. For example, 1,3-propanediol (PDO), used in the production of a specialist plastic called PTT (polytrimethylene terephthalate), can be produced from sugar using engineered E. coli. DuPont Tate & Lyle BioProducts operates a production plant using this method, with a capacity of around 77,000 t/year.

Ruminant microbes

One industrial chemical that could be produced using biotechnology is fumaric acid, used in the production of polyester resins and as a food additive. Although common in nature, and an intermediate in human and animal metabolic processes, fumaric acid is made industrially from fossil resources. Now, German collaborative project FUMBIO (FUMarsäure BIObasiert) is looking to ferment it from sugar and carbon dioxide, using a modified bacterium found in the stomachs of cows.

‘Reducing carbon dioxide is one of the drivers for FUMBIO,’ says Barbara Navé, who leads the research and is responsible for new white biotechnology projects at BASF. ‘Theoretical estimates suggest the carbon footprint of our fumaric acid could be as low as zero.’

The bacterium, called Basfia succiniciproducens, was isolated in 2008. It helps cows convert sugars into short chain carbonic acids, including succinic acid. The project aims to develop a viable strain of the bacterium – at lab scale – that produces less succinic acid and more fumaric acid. It will use genetic engineering tools to achieve this, by modifying key enzymes.

‘Fumaric acid is a natural intermediate in the production of succinic acid and we are working on accumulating this,’ she says.

Fumaric acid is not an ‘end product’ for BASF, but a ‘platform chemical’ from which other chemicals can be made. It can be converted to aspartic acid, for instance, then polymerised to polyaspartate – a kind of hydrogel with applications in areas such as water purification.

‘The main challenge of FUMBIO will be to achieve high enough levels of fumaric acid,’ says Navé. ‘Later on – but this is not part of this project – we will have to scale up the process to hundreds of litres and further optimise the strain to ensure cost efficiency.’

Other project partners are the universities of Saarland, Marburg and Kaiserslautern-Landau. They will focus on strain development, fermentation conditions and enzyme improvement, while BASF focuses on processing of the fermentation broth. Fumaric acid produced this way uses CO2 from industrial off-gases rather than petroleum as a raw material, Navé says, so helping the company to achieve its climate targets. While too early to estimate a timeframe for commercialisation, projects of this type usually take eight to 10 years until they are fully industrialised. In terms of volume, she adds that ‘commercially viable scales’ of fumaric acid tend to start at 10,000-20,000t/year.

The Fumbio project is using a bacterium derived from a cow's digestive system to produce a plastic precursor chemical called fumaric acid

Image: BASF

Aniline production

Another mainstream chemical, aniline – with a world production volume of 6m t/year – might also be made commercially using a biotechnology route in future. In the plastics industry, aniline is a precursor for methylene di-isocyanate (MDI), used in products such as insulating foam. Germany-headquartered performance and speciality chemicals company Covestro has recently devised a process to make aniline from plant biomass instead of petroleum.

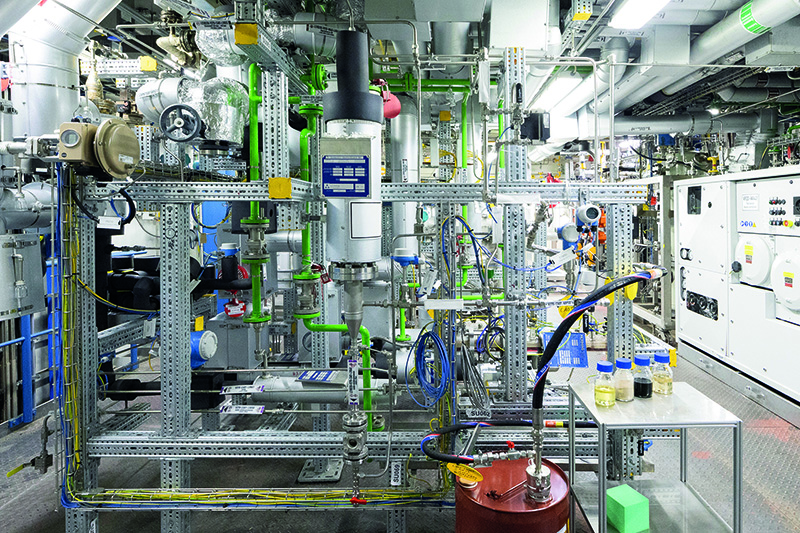

Few details are being divulged, but the company has set up a pilot plant at its facility in Leverkusen to produce ‘large quantities of bio-based aniline’ using the new method. The ultimate plan is to transfer this to industrial scale. Currently, Covestro produces around 1m t/year of aniline in the conventional way: by converting benzene – a crude oil derivative – into nitrobenzene, then hydrogenating this to aniline. Its bio-aniline project uses fermentation to convert a range of carbohydrates into an intermediate product; after purification, this is converted into aniline in a conventional chemical reaction. The project began around 10 years ago, and in that time Covestro has produced several tonnes of the intermediate using fermentation.

‘We’re performing the chemical step in the pilot plant,’ says Thomas Voessing, Project Lead at Covestro. ‘Now, we can convert the intermediate into aniline in a continuous process.’

The pilot plant cannot make commercial quantities of aniline, but Voessing says the aim is not to hit a particular output figure, but to generate know-how. Data produced in the pilot plant should reveal details of the chemical reaction.

‘We need this information to move to the next step – a demonstration plant,’ he says. ‘This would show the technology in a full industrial environment.’

For now, Voessing says it is too early to speculate on when a demonstration plant might be ready. The work is underpinned by a project called BioPURdemo, which has received three rounds of funding since it was set up in 2016. Partners include the University of Stuttgart – which handles strain development and process optimisation – and RWTH Aachen, with responsibility for the chemical reaction step. There are many challenges with scale-up: in the lab, raw materials are typically analytical grade; and side reactions may lead to unwanted compounds.

‘We must check all these different processes and develop a holistic process that works at large scale,’ he says.

The ultimate goal is a world-scale bio-aniline plant. To compete with a conventional aniline plant, this would need to produce at least 100,000t/year, he says – although he has no timescale for when this might happen. Covestro is also claiming a dual environmental advantage of its method: as well as shunning the use of petrochemicals, the product is used in the production of insulating foam, which itself helps to conserve energy.

Covestro is producing bio-based aniline at a pilot plant in Leverkusen, Germany - with plans to scale up to industrial quantities in the future

Image: Covestro

Polymer production

Meanwhile, researchers also have various other polymers in their sights for conversion from traditional production to bio-based routes. For instance, Hyosung of South Korea is investing $1bn in multiple biotechnology facilities to produce 1,4-butanediol (BDO) – a precursor for many polymers including elastane/spandex fibre (which is made under trademarks including Lycra). The ‘Bio-BDO’ will be made by fermenting sugars from sugar cane, rather than relying on fossil-based raw materials, using technology from US-based Genomatica. The first facility will be a 50,000t/year plant in Vietnam, due to open in early 2026. In addition, the company plans to build other production facilities, with a total capacity of 200,000t/year. Hyosung claims its Bio-BDO has 10% of the carbon footprint of BDO made in the traditional way.

Also in South Korea, food company Daesang has used a bio-based route to make sample quantities of cadaverine, used in the production of nylon and polyurethane. Usually, cadaverine is synthesised from hexamethylenediamine. Daesang’s bio-based version is made from lysine, an amino acid that Daesang already produces in-house, and which is typically added to animal feed. Although still in the early stages of commercialisation, demand for ‘bio-cadaverine’ could reach 1.6m t by 2026 if it completely replaces petroleum-based alternatives, the company says.

The promise of biotech

Despite the promise of industrial biotechnology, it is unlikely to displace traditional chemical processes over the next decade. ‘Will it become the majority of chemical production in that time?’ asks Dadhania of IDTechEx. ‘No, there are too many challenges to overcome.’

That said, it is likely to grow by becoming ever more specialist and efficient. One route is through the use of non-model organisms (NMOs) – species that are typically less well known. While the benefits of strains like E. coli and S. cerevisiae (brewer’s yeast) are well understood, so are their limitations. NMOs, while less studied, may offer new opportunities if they can be scaled to generate end products with a high yield.

Another approach is to use cell-free (CF) systems. Here, instead of producing a fermented product using a microbe, the reaction is driven by the key enzyme within the cell.

‘This allows you to produce your target molecule with much higher yield, by cutting out unwanted byproducts,’ Dadhania says. A recent plastics industry example of a cell-free system is in the bio-recycling facility opened earlier in 2024 by Carbios in France. It uses an enzyme – rather than a microbe – to convert polyethylene terephthalate (PET) waste back into its base monomers, which can later be re-polymerised.

Biotechnology has helped to revolutionise the medical and pharmaceuticals sectors and, on current evidence, could have a similar effect on industrial production. If promising techniques can be scaled up, expect to see more products fermented from wastewater, woody biomass and agricultural waste – rather than synthesised from petroleum.

Greener car tyres

Isoprene is a precursor for some types of synthetic rubber and is typically derived from crude oil. It is a colourless, volatile hydrocarbon with the formula C5H8 that can be polymerised into polyisoprene, which resembles natural rubber and is used in applications such as car tyres.

In nature, many substances in plants – such as terpenes – are built from isoprene units. Engineered bacteria, such as E. coli, are able to break these plant substances down into isoprene.

Tyre manufacturer Goodyear has been trying to commercialise bio-based isoprene for many years. Back in 2012 – in collaboration with DuPont – it showed a prototype bio-isoprene tyre at the Geneva motor show.

In October 2023, it signed an agreement with US-based biotech specialist Visolis that it hopes will accelerate the development of bio-isoprene. The collaboration will use Visolis technology to produce isoprene from lignocellulosic feedstocks – non-edible biomass and agricultural materials. In addition, Visolis will work with Japan-based Zeon to try to commercialise bio-isoprene using a combination of fermentation and chemical catalysis. In April 2024, Zeon synthesised a bio-based styrene-isoprene-styrene (bio-SIS) block copolymer using Visolis technology. SIS is commonly used in applications that need flexible and impact-resistant materials, such as adhesives and sealants. At the same time, Visolis says it has achieved a 50-fold increase in its production capacity of bio-isoprene monomers.

Researchers also propose to make isoprene from wastewater using engineered E. coli to convert dissolved glucose, maltose, glycerol and lactate (Front. Env. Sci. Eng., 2023; DOI: 10.1007/s11783-024-1788-3). This route is claimed to roughly halve the cost – and CO2 emissions – of both sugar fermentation and fossil fuel-based methods, said the group from China.